ПОИСК

- 葡萄酒 | 威士忌 | 白兰地 | 啤酒 -.

- 葡萄酒 | 威士忌 | 白兰地 | 啤酒 -.

Recently, I’ve noticed many discussions in automotive forums about vehicle router purchasing decisions, and it’s clear that many users are confused about OEM versus aftermarket concepts. As someone who has spent several years in the connected vehicle industry, I’d like to share some insights on this topic today.

Let me start with the basic definitions. OEM (Original Equipment Manufacturer), also called pre-installed or factory-installed, refers to equipment installed directly by automakers on the production line before vehicles leave the factory. Aftermarket refers to equipment installed after the vehicle has been manufactured, either by car owners themselves or professional installation shops. This classification applies not only to routers but also to dash cams, navigation systems, and audio upgrades.

The OEM automotive market is characterized by exceptionally high entry barriers. Breaking into an automaker’s supply chain requires meeting stringent requirements that go far beyond consumer electronics standards.

First and foremost are the various certifications. Automotive-grade requirements far exceed those for consumer electronics products. Certifications like AEC-Q100, ISO 26262, and IATF 16949 are mandatory. Temperature testing alone requires full-range validation from -40°C to 85°C, plus thousands of hours of aging tests. When our company pursued OEM certification years ago, testing costs alone reached several hundred thousand dollars, and the process took 18 months.

OEM project development cycles typically span 2-3 years. From project initiation, design, sampling, testing, to final mass production, every stage requires repeated verification. Automakers audit every single chip on the BOM (Bill of Materials), and suppliers must demonstrate long-term stable supply capabilities. I’ve witnessed projects requiring complete redesigns because a single capacitor was discontinued.

OEM products are almost always deeply customized. Different automakers have different CAN bus protocols, different infotainment systems, and different aesthetic requirements. A product designed for BMW cannot simply be used for Mercedes-Benz. This makes standardization nearly impossible for OEM products—each project requires independent development.

The profit distribution in the OEM market is quite interesting. Automakers take the largest share, Tier 1 suppliers receive moderate profits, while actual hardware manufacturers earn relatively thin margins. However, the volume compensates—once you enter a vehicle model’s supply chain, you have stable orders for several years. Some popular models sell hundreds of thousands of units annually, which remains attractive for hardware manufacturers.

In contrast, the aftermarket vehicle router segment offers much greater flexibility, which is why many startups choose to enter through this channel.

Aftermarket products can quickly respond to market demands. If users report a feature isn’t working well, improvements can be implemented in the next production batch. Development cycles are short—from concept to market launch may take only 3-6 months. This speed is impossible in the OEM market.

Aftermarket products don’t require automotive-grade certification and can use consumer-grade chips, immediately reducing costs. The material cost of an OEM vehicle router might be 3-4 times that of an aftermarket unit. However, this doesn’t mean aftermarket products are inferior—they simply serve different application scenarios with different standard requirements.

Aftermarket products enjoy diverse sales channels: e-commerce platforms, auto parts stores, dealerships, and modification shops. Marketing approaches are more flexible, including live streaming, influencer promotions, and community marketing. I know someone in the aftermarket car WiFi business who moves thousands of units monthly through social media alone.

From a technical perspective, OEM and aftermarket products follow completely different design philosophies.

OEM products typically connect directly to the vehicle’s power system, requiring handling of various complex scenarios: voltage drops during engine start, voltage fluctuations from alternator output, and even reverse polarity protection. The power management module must be extremely reliable.

Aftermarket products generally draw power from cigarette lighter or OBD ports, facing a relatively friendlier power environment. While voltage fluctuations must still be considered, the complexity is far lower than OEM requirements.

OEM products are installed inside the dashboard with poor heat dissipation conditions. Summer interior temperatures can reach 70-80°C (158-176°F). Therefore, thermal design is critical, with some high-end solutions using aluminum housings to conduct heat directly to the vehicle’s metal frame.

Aftermarket products have flexible installation locations with better ventilation, reducing thermal pressure. However, vigilance is still needed, as prolonged sun exposure can create high interior temperatures.

OEM antennas are typically integrated at specific vehicle locations, requiring extensive communication with automaker engineers to balance signal coverage and vehicle aesthetics. Some luxury models hide antennas in shark fins or side mirrors.

Aftermarket antennas are mostly external or simple internal designs, offering greater design freedom, though performance may be affected by installation location.

OEM market users are new car buyers who value factory quality, seamless integration, and warranty support. These users typically aren’t tech-savvy and prefer hassle-free solutions.

Aftermarket users are more like DIY enthusiasts or those with special connected vehicle needs. They might be truck drivers requiring navigation and tracking, road trip enthusiasts needing stable internet, or tech enthusiasts wanting to experiment with various features.

OEM product pricing is opaque, often bundled in vehicle option packages. Separated out, they might cost thousands or even tens of thousands of dollars. However, consumer perception is weak—they view it as part of the vehicle.

Aftermarket product pricing is transparent, ranging from a few hundred to over a thousand dollars. Consumers comparison shop, making value proposition a key consideration.

OEM products emphasize stability and basic functions: connectivity, positioning, basic data transmission. Complex features are rarely implemented, considering acceptance across diverse user bases.

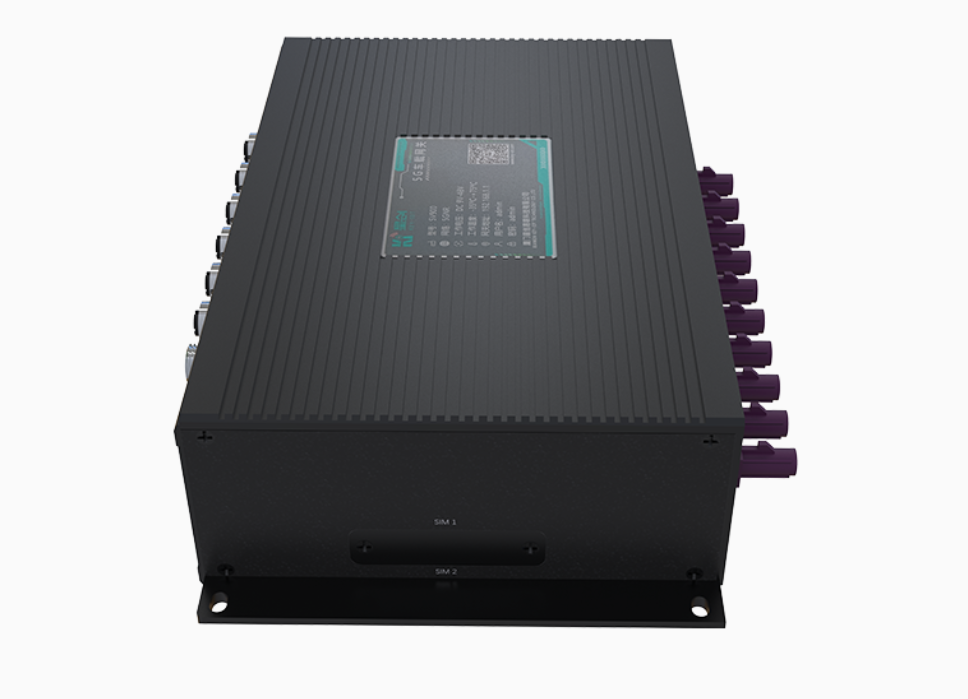

Aftermarket products feature more aggressive functionality: dual SIM dual standby, WiFi 6, 5G, even video surveillance. This targets users specifically needing these advanced capabilities.

Let me provide some practical examples.

A new energy vehicle manufacturer’s connected car system integrates the router within the T-Box, handling vehicle OTA updates, remote control, and vehicle condition monitoring. Users are completely unaware of the router’s presence, yet it works continuously in the background. This typifies the OEM approach—pursuing transparency and maintenance-free operation.

A long-haul truck driver installed a 4G router with two SIM cards from different carriers. On highways, he uses one carrier; in mountainous areas, he switches to another, ensuring constant connectivity. This router also provides internet for his dash cam and portable refrigerator. Such requirements are difficult for OEM products to satisfy and must rely on aftermarket solutions.

As vehicle connectivity technology evolves, the boundary between OEM and aftermarket is actually blurring.

Some aftermarket companies are penetrating the OEM space, starting with niche brands and new energy vehicle manufacturers, then advancing toward traditional major automakers after gaining experience. Simultaneously, OEM companies are launching “semi-aftermarket” products—maintaining OEM quality while simplifying installation to expand market share.

The adoption of 5G and C-V2X technology will further drive vehicle router development. The future may see hybrid models combining OEM hardware with aftermarket software—hardware provided by automakers, software and services by third parties, creating a more open ecosystem.

The division of vehicle routers into OEM and aftermarket categories is fundamentally determined by the automotive industry chain’s unique characteristics. OEM pursues reliability, consistency, and long lifecycles; aftermarket pursues flexibility, innovation, and rapid response. Each market has its own approach and opportunities.

For average consumers, factory-installed OEM solutions offer peace of mind with new vehicles. For those wanting special features or upgrading older vehicles, aftermarket options provide flexibility. There’s no absolute better choice—it depends on your specific needs.

Key Takeaways:

Feel free to leave comments below with any questions. Let’s discuss and learn together about automotive connectivity solutions.

Мо