SEARCH

— 葡萄酒 | 威士忌 | 白兰地 | 啤酒 —

— 葡萄酒 | 威士忌 | 白兰地 | 啤酒 —

In 2020, when we discussed automotive Electronic and Electrical Architecture (EEA), we were still talking about upgrading from distributed architecture to domain control architecture. The central computing unit + zone controller architecture seemed far out of reach .According to Bosch’s definition of EEA development stages, there were still more than five years to go .However, four years later today, we find that various OEMs’ central computing unit architectures are all about to land, such as XPeng’s X-EEA3.0 central computing platform + zone control architecture, GAC Aion’s central computing platform architecture – Xingling Architecture, Great Wall’s computing platform architecture GEEP3.0, and Li Auto’s LEEA3.0 architecture .

Behind the rapid iteration of electronic and electrical architecture is the convergence of vehicle communication networks. Starting from domain control architecture, using Ethernet as the backbone network for automotive communication has become a consensus among OEMs. As electronic and electrical architecture iterates toward quasi-central computing, OEMs’ demand for Ethernet chips has begun to explode .XPeng G9 adopts gigabit Ethernet as the backbone network’s X-CA communication architecture, and the Wenjie M9’s CC architecture uses Ethernet as the backbone network .Automotive Ethernet is a local area network technology specifically designed for automotive environments. It is based on traditional Ethernet protocols but optimized and adjusted for the special needs of vehicle internal networks .Compared to other technologies, automotive Ethernet has the following advantages:

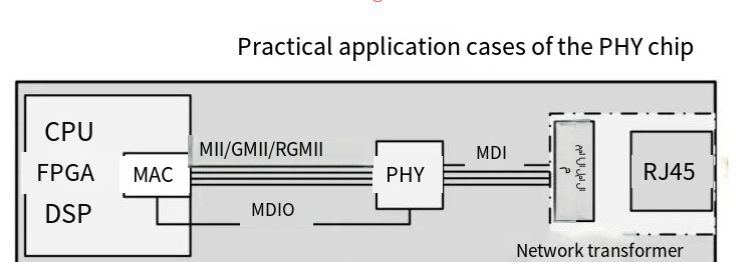

Key chips needed for automotive Ethernet mainly include Physical Layer Transceiver chips (PHY) and TSN Switch chips .PHY chips: Can be compared to signal base stations, implementing Ethernet physical layer functions, responsible for converting digital signals to signals suitable for physical medium transmission and performing corresponding encoding/decoding .Switch chips: Can be compared to traffic hubs, serving as the core of network switching, responsible for forwarding data packets between different network nodes for efficient data transmission .Switch chip main functions include:

With continuous evolution of automotive electronic architecture, demand for Ethernet chips has surged. For single vehicle value, the Mercedes EQS uses 5-7 Switch chips, averaging about $30 per chip, with 10-15 PHY chips, totaling around $300 in value .L4-level vehicles are expected to carry over 100 Ethernet chips, including 12 cameras + 4 displays, plus 7 TSN switch chips and others, bringing single vehicle Ethernet chip value to $700 .According to Ethernet Alliance predictions, by 2025 China’s Ethernet chip market will reach 30 billion yuan, making it the most significantly growing region .Data from China Automotive Technology Research Center and Shanxi Securities predicts that by 2025, domestic automotive Ethernet PHY chip market size will exceed 12 billion yuan RMB with CAGR over 30%. Switch chip market size will reach 17.8 billion yuan RMB .

Current automotive Ethernet PHY chip suppliers show highly concentrated patterns, mainly dominated by foreign companies like Marvell, Broadcom, NXP, and TI, with combined market share of 99%. Domestic PHY chip suppliers include only a few like Yutaiwei, Jinglue, and Yitaiwei .For Switch chips, suppliers are even more concentrated with only two US companies: Marvell and Broadcom. Domestic Switch chip autonomous supply is blank .Technical barriers for Switch chip development include:

6. Future of Automotive Ethernet

Looking at NVIDIA’s current progress, ADAS domains typically use 1 Ethernet switch chip, while advanced ADAS systems use 2-3 chips .In the Zonal era or central computing era (software-defined vehicle era), more Ethernet switch chips will be used, with each vehicle needing 6-7 chips .According to QY Research’s latest report, global automotive Ethernet market size is expected to reach $21.06 billion by 2029. As China leads global automotive intelligence, this track will nurture multiple listed companies .

Mo